Economics Model Essay 12

(a) Explain whether the demand for private cars is elastic or inelastic in Singapore with respect to price and income. [10]

(b) Discuss the effects of a sharp rise in the prices of Certificates of Entitlement in Singapore on expenditure by consumers on different types of cars. [15]

Introduction

a) The price elasticity of demand (PED) for a good is a measure of the degree of responsiveness of the quantity demanded to a change in the price, ceteris paribus. The income elasticity of demand (YED) for a good is a measure of the degree of responsiveness of the demand to a change in income, ceteris paribus.

Body

The demand for private cars is likely to be price elastic in Singapore. PED can be expressed mathematically as

% Δ Quantity Demanded

PED = ————————————–

% Δ Price

The PED for a good is negative due to the law of demand and the common practice among economists is to omit the negative sign. If the PED for a good is greater than one, such as in the case of luxury watches, the demand is price elastic which means that a change in the price will lead to a larger percentage change in the quantity demanded. If the PED for a good is less than one, such as in the case of food, the demand is price inelastic which means that a change in the price will lead to a smaller percentage change in the quantity demanded. The demand for private cars is likely to be price elastic in Singapore due to several reasons. There are many substitutes for private cars in Singapore which include private-hire car services, taxi services, bus services and train services. Some of these alternative modes of transport are close substitutes for private cars. For example, the types of vehicles which are used to provide taxi services and private-hire car services are the same as those which are used by private motorists and hence they provide a similar level of comfort and convenience. Private cars have a low degree of necessity in Singapore due to the small size of the country. The land area of Singapore is only about 720 square kilometres. The proportion of income spent on private cars is large in Singapore as private cars are expensive mainly due to the high cost of a Certificate of Entitlement (COE) and the high Additional Registration Fee (ARF).

The demand for private cars may be income elastic or inelastic in Singapore depending on the type of private car and the income group. YED can be expressed mathematically as

% Δ Demand

YED = ———————–

% Δ Income

If the YED for a good is positive, such as in the case of clothing, the good is a normal good. A normal good is a good whose demand rises when consumers’ income rises. There are two types of normal goods: necessity and luxury. The YED for a necessity is between zero and one which means that the demand is income inelastic. A necessity is a good whose demand rises by a smaller proportion when consumers’ income rises. The YED for a luxury is greater than one which means that the demand is income elastic. A luxury is a good whose demand rises by a larger proportion when consumers’ income rises. If the YED for a good is negative, such as in the case of public transport, the good is an inferior good which means that the demand will fall when consumers’ income rises. High-end private cars such as BMW cars are likely to be a luxury in Singapore and hence the YED is likely to be greater than one which means that the demand is likely to be income elastic. Mid-range private cars such as Honda Civic cars are likely to be a necessity in Singapore and hence the YED is likely to be between zero and one which means that the demand is likely to be income inelastic. Low-end private cars such as Chery QQ cars may be an inferior good in Singapore and hence the YED may be less than zero. To high income individuals, due to their high levels of income, private cars are likely to be a necessity and hence the demand is likely to be income inelastic. In contrast, to low income individuals, due to their low levels of income, private cars are likely to be a luxury and hence the demand is likely to be income elastic.

Conclusion

In conclusion, the demand for private cars is likely to be price elastic in Singapore and the income elasticity of demand depends on the type of private car and the income group.

Introduction

b) Consumer expenditure on a good is the amount of money that consumers spend on the good which is the product of the price and the quantity. The effects of a sharp rise in the prices of Certificates of Entitlement (COEs) in Singapore on expenditure by consumers on different types of cars can be discussed with reference to the concepts of demand, supply, price elasticity of demand, income elasticity of demand and price elasticity of supply.

A rise in the prices of COEs in Singapore may occur due to an increase in the demand. The demand for a good is the quantity of the good that consumers are willing and able to buy at each price over a period of time, ceteris paribus. Suppose that consumers’ income in Singapore is rising which is the normal state of the economy. An increase in consumers’ income will lead to an increase in the demand for cars as the YED is positive which means that they are a normal good. As the demand for COEs is a derived demand which depends on the demand for cars, an increase in the demand for cars will lead to an increase in the demand for COEs resulting in a rise in the price. As the supply of cars is perfectly price inelastic at the quota, an increase in the demand will lead to a rise in the price without affecting the quantity. Therefore, consumer expenditure will rise.

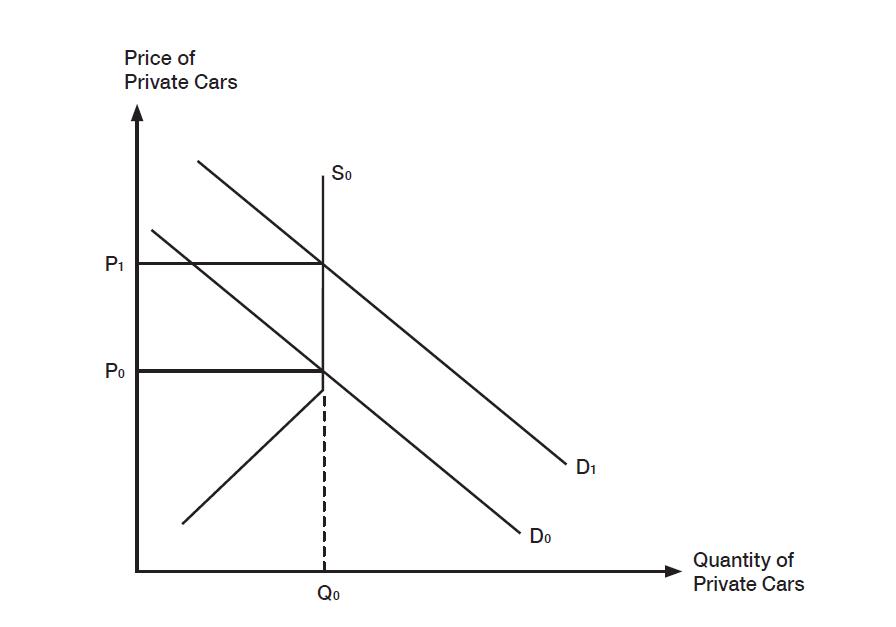

In the above diagram, due to the quota on cars which gives rise to the supply curve (S0) which is vertical at Q0, an increase in the demand (D) from D0 to D1 leads to a rise in the price (P) from P0 to P1. The quantity (Q) remains constant at Q0. High-end cars are a normal good in Singapore and hence the YED is positive. Therefore, an increase in consumers’ income will lead to an increase in the demand resulting in an increase in the consumer expenditure. Like high-end cars, mid-range cars are also a normal good in Singapore and hence the YED is also positive. Therefore, an increase in consumers’ income will also lead to an increase in the demand resulting in an increase in the consumer expenditure. However, unlike high-end cars where the YED is likely to be greater than one which means that the demand is likely to be income elastic as they are likely to be a luxury, mid-range cars are likely to have a YED between zero and one which means that the demand is likely to be income inelastic as they are likely to be a necessity. Therefore, the increase in the demand for mid-range cars and hence the increase in the consumer expenditure is likely to be smaller compared to high-end cars. Low-end cars may be an inferior good in Singapore and hence the YED may be less than zero. If this happens, an increase in consumers’ income will lead to a decrease in the demand resulting in a decrease in the consumer expenditure.

A rise in the prices of COEs in Singapore may occur due to a decrease in the supply. The supply of a good is the quantity of the good that firms are willing and able to sell at each price over a period of time, ceteris paribus. The Land Transport Authority (LTA) may decrease the supply of COEs to improve traffic conditions which will lead to a rise in the price. When the supply of COEs falls, the supply of cars will fall which will lead to a rise in the price and a fall in the quantity. Although the rise in the price will increase the consumer expenditure, the fall in the quantity will decrease the consumer expenditure. When the supply of cars falls, whether the consumer expenditure will rise or fall will depend on the PED. The demand for cars is likely to be price elastic due to the large proportion of income spent on the good as cars are generally expensive. Therefore, the quantity is likely to fall by a larger proportion than the rise in the price and hence the consumer expenditure is likely to fall.

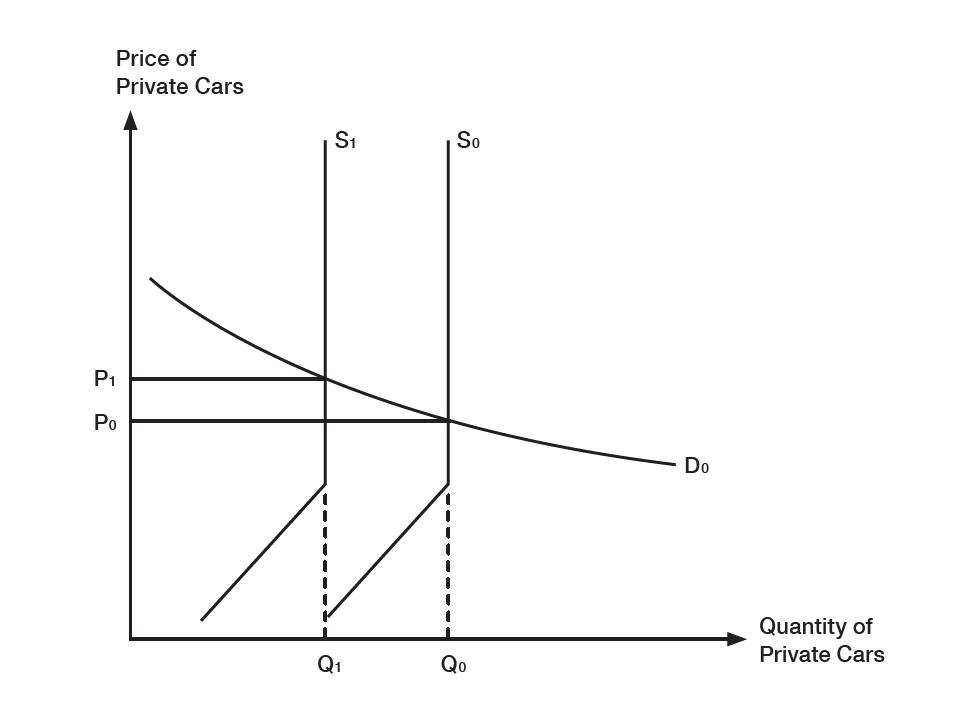

In the above diagram, due to the elastic demand which gives rise to the relatively flat demand curve (D0), a decrease in the supply (S) from S0 to S1 leads to a large fall in the quantity (Q) from Q0 to Q1 and a small rise in the price (P) from P0 to P1. High-end cars are expensive in Singapore and hence the proportion of income spent on high-end cars is large. Therefore, the demand is likely to be price elastic which means that a decrease in the supply is likely to lead to a decrease in the consumer expenditure. Although mid-range cars are cheaper than high-end cars, they are still fairly expensive and hence the proportion of income spent on mid-range cars is still fairly large. Therefore, the demand is also likely to be price elastic which means that a decrease in the supply is also likely to lead to a decrease in the consumer expenditure. However, as the PED for mid-range cars is lower than the PED for high-end cars due to the smaller proportion of income spent on mid-range cars, the decrease in the consumer expenditure on mid-range cars will be smaller than the decrease in the consumer expenditure on high-end cars. Low-end cars are the cheapest among the three types of cars and hence the proportion of income spent on low-end cars is the smallest. Therefore, the demand may be price inelastic. If this happens, a decrease in the supply will lead to an increase in the consumer expenditure as the proportionate rise in the price will be greater than the proportionate fall in the quantity.

Evaluation

In the final analysis, there is a need for some governments to reduce the use of private cars to curb traffic congestion and air pollution. The Singapore government is a case in point. The demand for private cars is high in Singapore due to the high level of income. According to the International Monetary Fund, Singapore has the third highest GDP per capita in the world, behind Qatar and Luxembourg. However, there is a small amount of road space in Singapore due to the small size of the country. The land area of Singapore is only about 720 square kilometres. In the absence of government measures to reduce the use of private cars in Singapore, a high demand for private cars coupled with a small amount of road space is likely to lead to severe traffic congestion. Furthermore, to curb traffic congestion, the government should not only reduce the use of private cars, it should also control the use of certain roads during certain hours of the day. For example, the major expressways in Singapore such as the Pan Island Expressway and the Central Expressway are congested in the early mornings when many people travel from their residences to their workplaces and in the late afternoons and early evenings when many people travel from their workplaces back to their residences. Therefore, the government should control the use of these roads during these hours to reduce traffic congestion through imposing a toll. For example, the Singapore government imposes a toll known as the Electronic Road Pricing (ERP) charge on the major expressways in the early mornings and in the late afternoons and early evenings to reduce traffic congestion.

The question will be discussed in economics tuition by the Principal Economics Tutor in greater detail.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Economics tutors and teachers who wish to use the materials for teaching may submit a request to Economics Cafe.

Economics Tuition Singapore @ Economics Cafe

Principal Economics Tutor: Mr. Edmund Quek